The People’s Budget

Budget of the Congressional Progressive Caucus

The People’s Budget eliminates the deficit in 10 years, puts Americans back to work and restores our economic competitiveness. The People’s Budget recognizes that in order to compete, our nation needs every American to be productive, and in order to be productive we need to raise our skills to meet modern needs.

Our Budget Eliminates the Deficit and Raises a $31 Billion Surplus In Ten Years

Our budget protects Social Security, Medicare and Medicaid and responsibly eliminates the deficit by targeting its main drivers: the Bush Tax Cuts, the wars overseas, and the causes and effects of the recent recession.

Our Budget Puts America Back to Work & Restores America’s Competitiveness

• Trains teachers and restores schools; rebuilds roads and bridges and ensures that users help pay for them

• Invests in job creation, clean energy and broadband infrastructure, housing and R&D programs

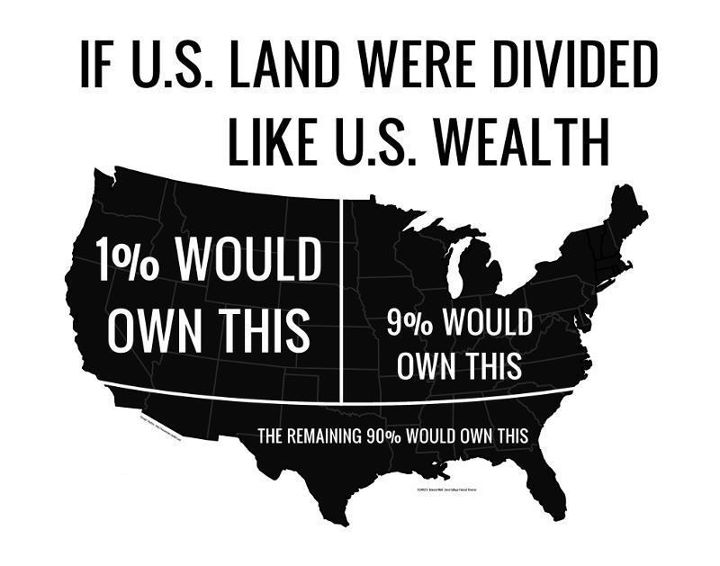

Our Budget Creates a Fairer Tax System

• Ends the recently passed upper-income tax cuts and lets Bush-era tax cuts expire at the end of 2012

• Extends tax credits for the middle class, families, and students

• Creates new tax brackets that range from 45% starting at $1 million to 49% for $1 billion or more

• Implements a progressive estate tax

• Eliminates corporate welfare for oil, gas, and coal companies; closes loopholes for multinational corporations

• Enacts a financial crisis responsibility fee and a financial speculation tax on derivatives and foreign exchange

Our Budget Protects Health

• Enacts a health care public option and negotiates prescription payments with pharmaceutical companies

• Prevents anycuts to Medicare physician payments for a decade

Our Budget Safeguards Social Security for the Next 75 Years

• Eliminates the individual Social Security payroll cap to make sure upper income earners pay their fair share

• Increases benefits based on higher contributions on the employee side

Our Budget Brings Our Troops Home

• Responsibly ends our wars in Iraq and Afghanistan to leave America more secure both home and abroad

• Cuts defense spending by reducing conventional forces, procurement, and costly R&D programs

Our Budget’s Bottom Line

• Deficit reduction of $5.6 trillion

• Spending cuts of $1.7 trillion

• Revenue increase of $3.9 trillion

• Public investment $1.7 trillion

Further Links

The People’s Budget Online

Official CPC executive summary

Support for the People’s Budget

President Bill Clinton

“The most comprehensive alternative to the budgets passed by the House Republicans and recommended by the Simpson-Bowles Commission”

“Does two things far better than the antigovernment budget passed by the House: it takes care of older Americans and others who need help; and much more than the House plan, or the Simpson-Bowles plan, it invests a lot our tax money to get America back in the future business”

Paul Krugman

“genuinely courageous”

“achieves this without dismantling the legacy of the New Deal”

Dean Baker

“if you want a serious effort to balance the budget, here it is.”

Jeffrey Sachs

“A bolt of hope…humane, responsible, and most of all sensible”

Robert Reich

“modest and reasonable”

The Economist

“Courageous”

“Mr Ryan’s plan adds (by its own claims) $6 trillion to the national debt over the next decade, but promises to balance the budget by sometime in the 2030s by cutting programmes for the poor and the elderly. The Progressive Caucus’s plan would (by its own claims) balance the budget by 2021 by cutting defence spending and raising taxes, mainly on rich people.”

The New Republic

“…something that’s gotten far too little attention in this debate. The most fiscally responsible plan seems to be neither the Republicans’ nor the president’s. It’s the Congressional Progressive Caucus plan…”

Rachel Maddow

“Balances the budget 20 years earlier than Paul Ryan even tries to”

The Guardian

“the most fiscally responsible in town… would balance the books by 2021“

Economic Policy Institute

National budget policy should adequately fund up-front job creation, invest in long-term economic growth, reform the tax code, and put the debt on a sustainable path while protecting the economic security of low-income Americans and growing the middle class. The proposal by the Congressional Progressive caucus achieves all of these goals.”