Trickle Down Economics

A Con by the One Percent on America’s Middle Class

by Mark Tracy

“Trickle down was nothing more than the politics of helping the rich and powerful get richer and more powerful, and it cut the legs out from under America’s middle class.”

—Sen. Elizabeth Warren

“Ronald Reagan’s theory was really ‘trickle down’ economics borrowed from the Republican 1920s (Harding-Coolidge-Hoover) and renamed ‘supply side.’ Cut tax rates for the wealthy; everyone else will benefit. As Reagan’s budget director David Stockman confided to me at the time, the supply-side rhetoric ‘was always a Trojan horse to bring down the top rate.’ Many middle-class and poor citizens figured it out, even if reporters did not.”

—William Greider, “The Gipper’s Economy”

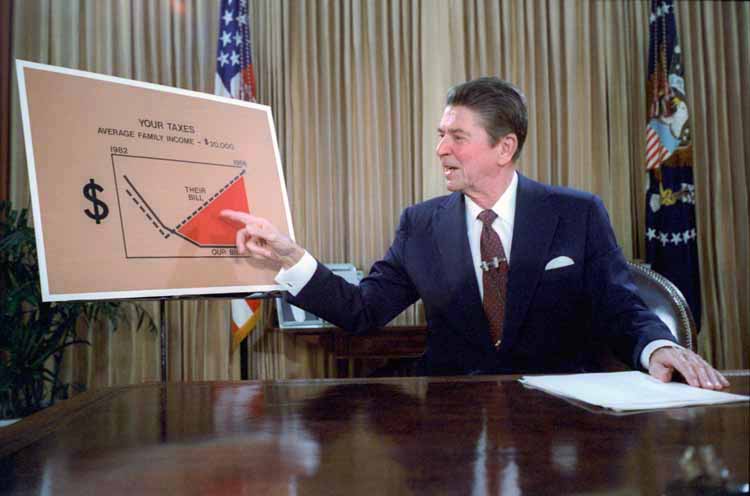

Early in his presidency, Reagan chose as his economic advisers a group that espoused a radical economic theory called “supply side.” The supply siders told Reagan that if he gave tax cuts to the top brackets (the wealthiest individuals) the positive effects would “trickle down” to everyone else. Tax cuts, they argued, would produce so much extra growth in the economy — and therefore extra tax revenue — that America could simply outgrow its deficits. The proposition was that tax cuts would pay for themselves. Reagan bought into supply side theory, which is why in 1981 he predicted that there would be a “drastic reduction in the deficit”:

“A drastic reduction in the deficit…will take place in the fiscal year ’82.”

—President Reagan, news conference, cited in The New York Times, March 6, 1981. (In fiscal 1982, the first full year of Reagan’s presidency, the government ran up a record budget deficit of $128 billion.)

However, Reagan soon discovered that his supply side advisers were wrong. Tax cuts, instead of reducing the deficit, caused the deficit to balloon. After 1981, Reagan made no more rosy predictions regarding the deficit.

At this point, Reagan would change strategy. He would blame the U.S. Congress for the record deficits that accrued during his years in office. Reagan would say that Congress was responsible, because Congress did not slash spending enough — meaning social spending, since Reagan always championed increased military spending.

Reagan chose to ignore the fact that his own Republican Party was in control of the Senate from January 1981 to January 1987, and that Congress actually spent less than what he originally had asked for. (for details click here)

|

Reagan Years : Deficit/Debt

|

|||

| Year | Deficit | Debt | Debt as a percentage of that year’s GDP |

| 1979 | –$40,183 | –$828,923 | 34% |

| 1980 | –$73,835 | –$908,503 | 34% |

| 1981 | –$78,976 | –$994,298 | 34% |

| 1982 | –$127,989 | –$1,136,798 | 36% |

| 1983 | –$207,818 | –$1,371,164 | 41% |

| 1984 | –$185,388 | –$1,564,110 | 42% |

| 1985 | –$212,334 | –$1,816,974 | 46% |

| 1986 | –$221,245 | –$2,120,082 | 50% |

| 1987 | –$149,769 | –$2,345,578 | 53% |

| 1988 | –$155,187 | –$2,600,760 | 54% |

| 1989 | –$152,481 | –$2,867,538 | 55% |

| U.S. Office of Management and Budget, Historical Tables, annual, all numbers in millions | |||

Federal deficits would continue unabated until the presidency of Bill Clinton when fiscal responsibility would finally be restored. President Clinton would achieve a balanced budget (and even record surpluses) in large measure by restoring higher taxes on the wealthy.

Addendum — The Post Clinton Years:

“America has a strong economy and a surplus…. Now is the time to reform the tax code and share some of the surplus with the people who pay the bills.”

—George W. Bush, nomination acceptance speech, 3 August 2000

After the election of 2000, Bush and a Republican-led Congress reduced income taxes, with the majority of the tax cuts going to America’s wealthiest individuals. With the introduction of Bush’s tax cuts, the budget surplus immediately disappeared and deficits resumed. By the end of Bush’s eight-year term, the national debt stood at $10 trillion — double its level when Bush assumed office.

“This is an impressive crowd — the haves and the have-mores. Some people call you the elites; I call you my base.”

—George W. Bush, at the annual Al Smith Memorial Foundation Dinner, 19 October 2000